How it works

Grameen Today small loans are for business purposes only and start at less than $4,500 repayable over a six month period.

Grameen Today small loans are for business purposes only and start at less than $4,500 repayable over a six month period.

Once a member has repaid their first loan, they may be able to access a second loan of up to $5,500, and when that loan is repaid a final loan of up to $6,500 may be available to scale up the business.

Unlike mainstream lenders, there are no credit checks and no collateral or security against the loan.

However, the member must commit to and step through the full program to access the loans which includes group meetings and training and other support.

Our program is for people who:

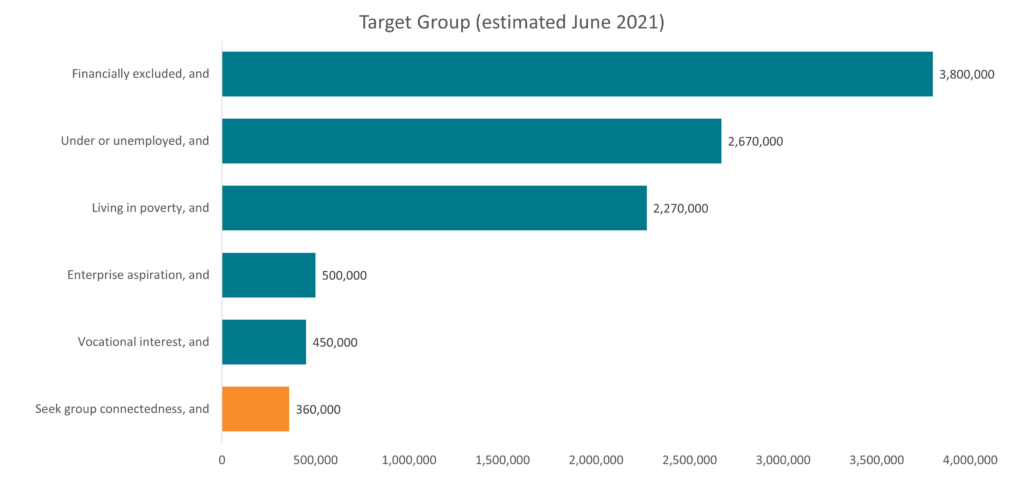

- are financially excluded – 3.8 million, and

- are unemployed or underemployed – 3.0 million, and

- are living in poverty – 2.27 million, and

- have an enterprise aspiration – 0.5 million, and

- have a vocational interest – 0.45 million, and

- seek group connectedness and are willing to work as part of a small group – 0.36 million

Eligibility

People who are looking to join Grameen Today as a member must meet the following eligibility criteria:

- Unemployed/underemployed

- Current income less than $45k for singles or $60k for a person with dependents

- Cannot access bank credit

- Can afford repayments

- Commit to group meetings

- Be living in a Grameen Today area (northern and western suburbs of Melbourne)

Six step process

Step 01

Enquiry

An individual makes an enquiry to learn more about the program. We provide information and support to help make informed decisions. Referrals to other services such as family violence, mental health and housing are provided where needed.

Step 02

Group formation

The individual joins Grameen Australia as a ‘member’ and creates a group with four other women. The Centre Manager supports the group to make connections, get to know each other and agree ways of working. The group meets on a weekly basis.Step 03

Peer support

We provide peer learning and capability building support to members before receiving their first loan and during weekly meetings to support their financial health.

Step 04

Loan

The member may be given access to a small loan to help them start or expand their business. The first cycle loan is between $1,000 to $4,500 with a fair interest rate and reasonable repayments over a six month period.Step 05

Operate

With the loan draw down, the member is ready to start or expand their business. Throughout each of the steps, the member has the ongoing peer support from their group and Centre Manager.Step 06

Review

The group celebrates the end of cycle one and considers opportunities to scale up or make improvements. Further loan capital may be provided at this stage.

“The system we have built refuses to recognize people. Only credit cards are recognized. Drivers’ licenses are recognized. But not people. People haven’t any use for faces anymore, it seems. They are busy looking at your credit card, your driver’s licence, your social security number. If a driver’s licence is more reliable than the face I wear, then why do I have a face?”

Professor Muhammad Yunus